Commercial Alternatives Shift the Landscape

Feb 13, 2025

As defense giants Lockheed Martin and Boeing push forward with competing designs for the next generation of satellites, the military satellite communications landscape is experiencing a major shakeup. The competition is for the $2.5 billion Mobile User Objective System (MUOS) Service Life Extension program run by the U.S. Space Force. The military’s ultra-high frequency narrowband satellite network is being modernized with the help of this crucial program, and in January 2024, each company received $66 million for the first phase.

Lockheed Martin HQ. Credit: Lockheed Martin

Lockheed Martin HQ. Credit: Lockheed Martin

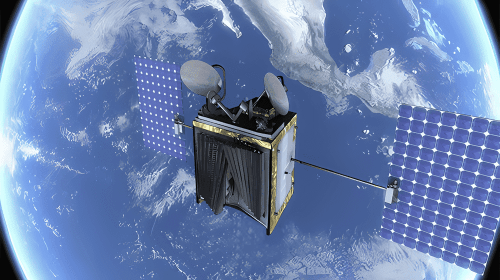

MUOS infrastructure is a highly sophisticated communication network operating in the ultra high frequency band, and using 3G cellular telephone technology for military communications. Essential voice and data services are provided to American forces and allied nations by the system, which was originally under U.S. Navy control, but is now operated by the Space Force. According to the program office, the new satellites will have greater power and more sophisticated communications technology than the current system, and the satellites will be launched by 2030, including MUOS SV6 and SV7.

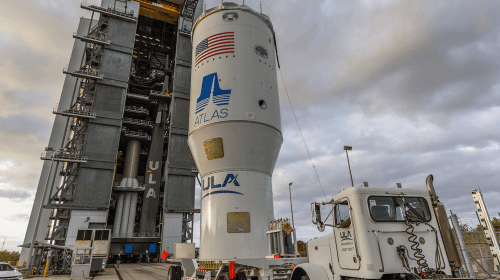

Lockheed Martin’s approach to the program is very technologically advanced, especially by partnering with a Raytheon Intelligence & Space subsidiary named SEAKR Engineering. The new payload processor developed allows in-orbit reprogramming, a substantial improvement over current capabilities. The new processor has reached Technology Readiness Level 6 (signifying that it is ready for production and deployment in the next generation of satellites). Boeing’s entry to the competition demonstrates its experience with a design based on the company’s proven 702MP satellite platform. In other words, this platform has already proven itself in other Space Force communications satellites, such as in the WGS-12 program. Military satellite production remains important to the company’s satellite manufacturing facilities in El Segundo, California, and the WGS-12, the last satellite due for delivery in January 2029, is still to be delivered.

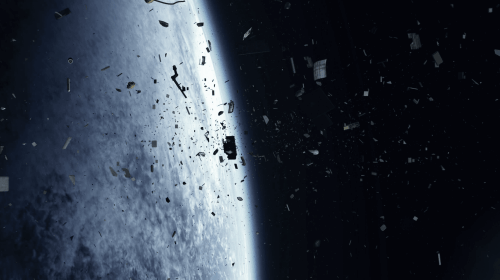

MUOS infrastructure currently includes four operational satellites and one spare in geosynchronous orbit that provide comprehensive communication services. In March 2023, the transition of control from the U.S. Navy to the Space Force meant significant change in operational management. This transfer reflects the changing nature of space-based military communications and the growing emphasis on space-based centralized operations management. The program faces mounting scrutiny as commercial alternatives emerge in the satellite communications sector. The officials at Space Force are keeping an eye on the growth of commercial satellite communications services that allow for direct smartphone-to-satellite connections. Senior military leadership have taken notice of the technology’s potential to disrupt existing military narrowband satcom systems and realize its transformative potential for military communications.

Companies like Iridium and AST SpaceMobile are creating solutions for direct smartphone-to-satellite connections in military communications. As a result, American Enterprise Institute experts and others question the need to continue with the MUOS extension program by arguing that commercial alternatives would be more economically and technologically viable. While waiting for such options to work out, Space Force officials still consider commercial communications satellite services as potential substitutes or complements to military schemes such as MUOS, which indicates the direction in which military communications, at least for the future, probably go — with a combination of military and commercial systems to address changing combat demands.