Does LEO + GEO beat LEO?

Jul 30, 2022

OneWeb, a UK based LEO (Low Earth Orbit) satellite operator has signed a Memorandum of Understanding, announcing its intention to merge with European rival Eutelsat, with the goal of taking on SpaceX and it’s Starlink service. The deal involves Eutelsat issuing 230 million new shares and exchanging them for the remaining shares of OneWeb. This will leave shareholders of both companies owning 50% of the combined firm. OneWeb has been valued at $3.4 billion. The combined company is expected to generate $1.22 billion (1.2 billion Euros) in revenue for the 2022-23 fiscal year. The companies project ongoing revenue growing annually in low double-digits for a decade, then increasing to mid-teen annual growth over the long term.

BusinessCom is viewing the recently announced Eutelsat/OneWeb merger with great interest. We have provided broadband services on Eutelsat satellites for many years, most recently rolling out new services on the iDirect-Newtec Dialog platform, which offers advanced efficiencies for mixed traffic types. See Introducing the Dialog Platform to learn more about this service we provide on a variety of Eutelsat satellite beams. We have also been following the LEO constellation deployments, including OneWeb who received a mention in one of our latest blog articles: Consumer LEO – Are There Enough Unconnected? Our interest in the LEO market as with the GEO market is primarily geared towards enterprise clients, rather than residential consumer services that seem to be the prime target for Starlink. We are enthused by OneWeb’s goal of marketing to enterprise clients through partners.

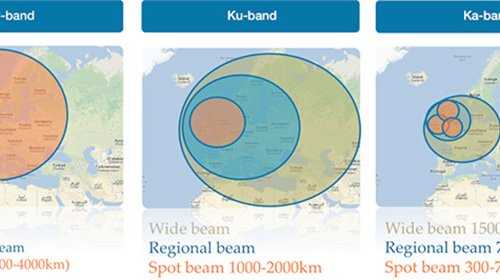

OneWeb plans to deploy 648 LEO satellites beaming broadband to rural locations with little or no internet. Of these, 428 are in orbit, which will combine with Eutelsat’s 36 GEO satellites. The future hybrid GEO/LEO infrastructure will include ground infrastructure, technology, and the design of the next generation, Gen-2, OneWeb constellation. The combination brings together two technologies, with LEOs adding global coverage and low latency to GEO high capacity and resiliency.

Initially Eutelsat will resell OneWeb’s LEO capacity as a standalone product but over the next year, they expect to bundle GEO/LEO for clients. One can imagine applications such as high-speed content uploaded to OneWeb LEO satellites, which is then passed to GEO satellites for broadcast over a wide geographic area. Over the next few years, the combined company plans to deliver a “mutualized network” using various tools and next-generation antennas. Some four to five years out, the OneWeb Gen-2 constellation will be fully operational and will support integrated offerings with intelligent routing to tie the platforms together.

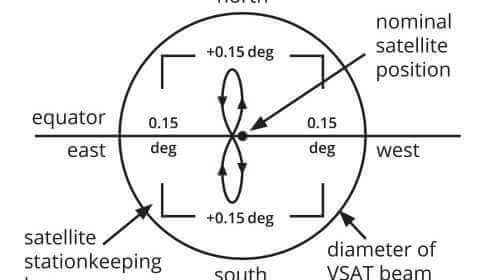

Eutelsat has stable video revenues that will support ongoing development of OneWeb’s Gen-2 constellation. Video distribution is best served by GEO satellites where latency is not a factor, and service level agreements (SLA) can be supported today. Of interest is whether SLAs can be supported for OneWeb services when its fleet is completed, particularly if that includes guaranteed make or break connections as satellites pass overhead, as discussed in the Consumer LEO article mentioned above. OneWeb has a distinct advantage over SpaceX in this regard, as their satellites are orbiting higher. This creates larger footprints such that the chances of a terminal on the ground being able to always “see” a OneWeb satellite passing overhead, is greater than it is for the smaller beams generated by Starlink’s lower LEO satellites. Starlink users, including some known to the author, have expressed significant frustration with things like trees getting in the way, and breaking connections as the satellites pass overhead. This is also why OneWeb does not need as many satellites to provide global coverage. Since it’s lower, Starlink has a small latency advantage, but the advantage of being lower has another downside. Starlink is going to be faced with trying to reach profitability before their first-generation satellites start coming into the atmosphere to burn up. Since these satellites must be replaced, costs may get out of hand if the company isn’t profitable by then. OneWeb’s satellites are higher, so they will take longer to fall out of orbit. Because they are higher, they may require more advanced end of mission mitigation solutions, such as having grapple fixtures attached to each spacecraft to pull them out of orbit when the time comes, or if there is a problem and a satellite needs to be replaced. It is feasible that OneWeb’s model may achieve profitability sooner, particularly if paired with GEO satellites to offer unique and integrated connectivity solutions.

OneWeb announced several years ago through former CEO Adrian Steckel that their services would be provided through partners, rather than using a direct sales model such as Starlink currently employs. They recognize the value partners bring in reaching new markets and dealing with governmental regulations in the many countries they want to sell services into. The distribution partnerships with a variety of ISPs and specialized satellite providers already established by OneWeb, is of interest to Eutelsat, who also works through partners such as BusinessCom Networks. OneWeb’s partners will also add key vertical markets and geographic regions that will benefit both GEO and LEO sales.

OneWeb has struggled since its inception to stay afloat. See OneWeb Good News/Bad News, Again The UK government helped bail out the company, taking a small stake, which does create some complications given that OneWeb is a UK company, and Eutelsat is based in Paris. With access to large cash infusions from Eutelsat, it appears that they have turned the corner, and are a player to be reckoned with. Many industry experts suggest the market will support at most three large LEO constellations, and this merger could secure OneWeb’s place, as it faces competitors like Starlink, Telesat Lightspeed and Amazon’s Kuiper. Only Telesat would be in position to offer a hybrid GEO/LEO service at this time.

BusinessCom has been a long-time partner of Eutelsat, and it looks like we may soon be able to market OneWeb. Stay tuned!